In the summer of 1910, the Inspector of Taxes for each of the valuation districts was provided with a printed leather-bound book. The first page contains the following words:

The Commissioners of Inland Revenue.

DUTIES ON LAND VALUES .

Record of Valuations made by the Commissioners of Inland Revenue, in accordance with the provisions of Part I of the Finance (1909/10) Act, 1910.

County of ……… Division of ………

A Valuation Book for the parish or place of ………

(as constituted on the sixth day of April, 19.., for the purposes of the Acts relating to Income Tax), in the aforesaid Division and County, showing the Original Total Value and the Original Site Value (or, in the case of Minerals, the Original Capital Value) of Land situate within the aforesaid parish or place, and, in the case of Agricultural Land, the value of the Land for Agricultural purposes, where that Value is different from the Site Value, as determined by the Commissioners of Inland revenue, and amended on appeal (if any); together with the several deductions allowed in determining any Value.

I, the undersigned Valuer, acting in and for the parish or place aforesaid, do hereby certify that, to the best of my knowledge and belief, this book contains particulars in respect of every hereditament in the said parish or place, that the entries herein made, and amended, where necessary, are in all respects true and correct, and that the Original Valuation of the said parish or place was completed on ……

this ….. day of …… 191..

…………………….. Valuer.

Form 20. – Land

H.G. & S. 3,000. 14/5/10.

Walter Richard Warmington, landlord of The Bell Inn at Badsey, was the Inspector of Taxes for the Aldington district. He described himself in the 1911 census return as “Beerhouse Keeper, Collector of rates, taxes etc”. Warmington had to extract details from the Poor Rate Book and enter them in the Valuation Book. In the inside front cover, he wrote down the page numbers for each parish: Aldington 1-12; Badsey 14-47 & 88; Bretforton 48-71; Wickhamford 72-87.

Walter Richard Warmington, landlord of The Bell Inn at Badsey, was the Inspector of Taxes for the Aldington district. He described himself in the 1911 census return as “Beerhouse Keeper, Collector of rates, taxes etc”. Warmington had to extract details from the Poor Rate Book and enter them in the Valuation Book. In the inside front cover, he wrote down the page numbers for each parish: Aldington 1-12; Badsey 14-47 & 88; Bretforton 48-71; Wickhamford 72-87.

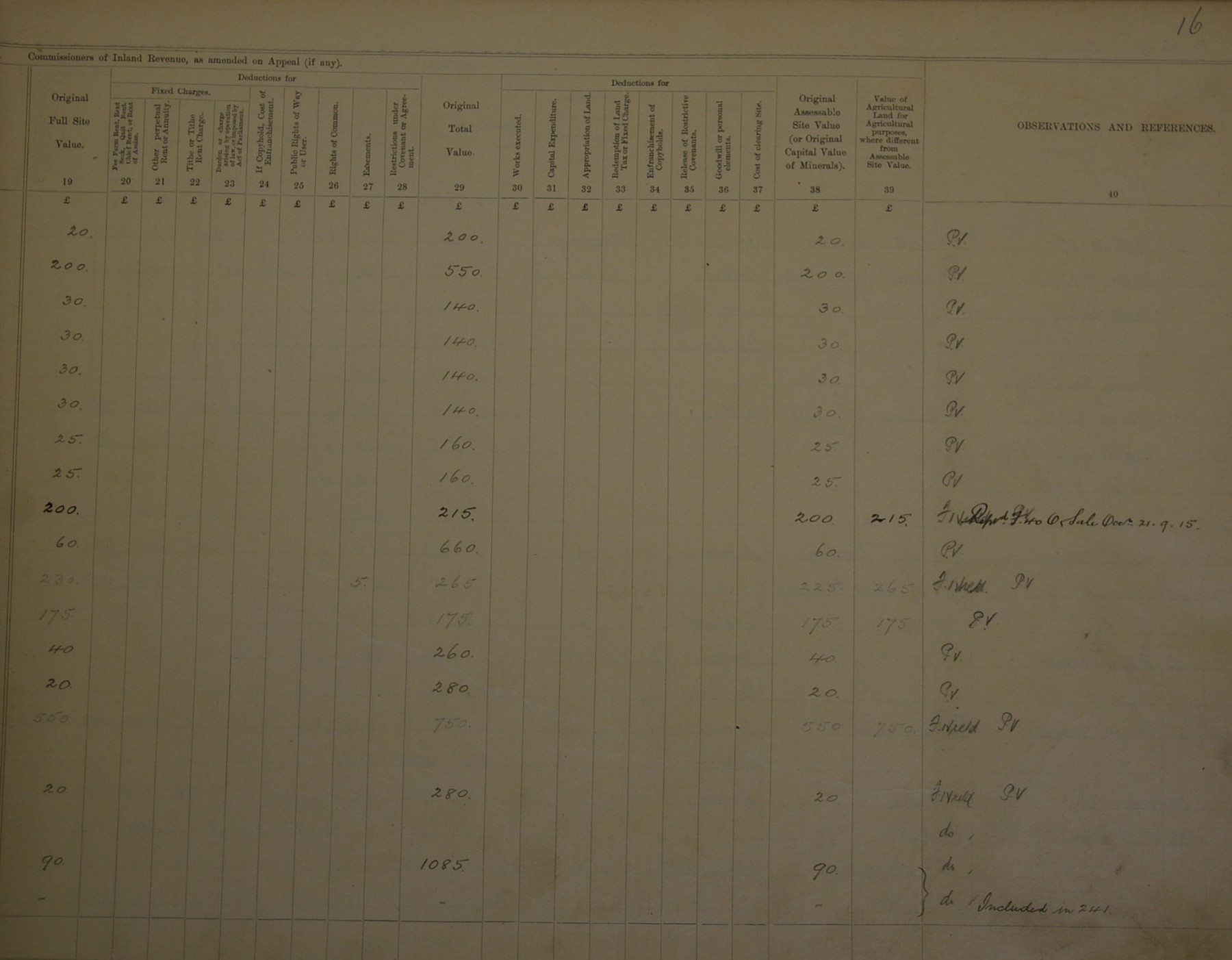

There were 40 columns, but the Inspector had only to complete Nos 1-9:

1 – Number of Assessment

2 – Number of Poor Rate

3 – Christian Names and Surnames of Occupiers

4 – Christian Names and Surnames of Owners, with their Residences

5 – Description of Property

6 – Street, Place, Name and Precise Situation of Property

7 – Poor Rate, estimated extent (acres and roods) - the estimated extent is given in acres and roods (no perches); sometimes this appears to differ greatly from the Field Books; the Field Books, which give the extent in acres, roods and perches, has been used in preference to the valuation books.

8 – Poor Rate, gross annual value (pounds and shillings in the Valuation Books; pounds, shillings and pence in the Field Books)

9 – Poor Rate, rateable value (pounds and shillings)

Column 10 gives details of map reference number which was filled in at a later stage. Columns 11-14 give the extent as determined by the Valuer (only filled in for some assessment numbers). For example, No 4 was originally estimated at 7 acres 1 rood, but the valuer determined it as 87a 0r 28p, which was because several assessment numbers were combined. Columns 11-39 relate to determination of Commissioners of Inland Revenue as amended on appeal (if any). Only some assessment numbers have entries.

The initials look like T.H.H.

At the end of each parish section, Warmington gave the totals:

|

Poor Rate |

Estimated Extent |

Gross Annual Value |

Rateable Value |

|||

|

|

Acres |

Roods |

£ |

s |

£ |

s |

|

Aldington |

625 |

3 |

3733 |

10 |

3116 |

18 |

|

Badsey |

1115 |

0 |

4880 |

10 |

4357 |

1 |

|

Bretforton |

1608 |

0 |

5671 |

1 |

4635 |

2 |

|

Wickhamford |

1211 |

0 |

2612 |

18 |

2385 |

12 |